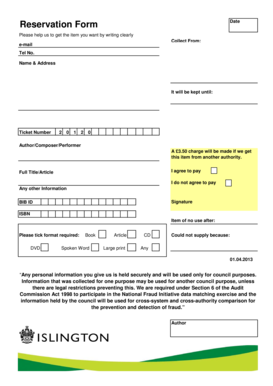

Morehouse College Student Request for 1098-T Form 2011-2025 free printable template

Get, Create, Make and Sign 2011 morehouse 1098t form

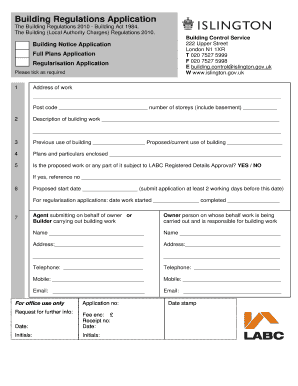

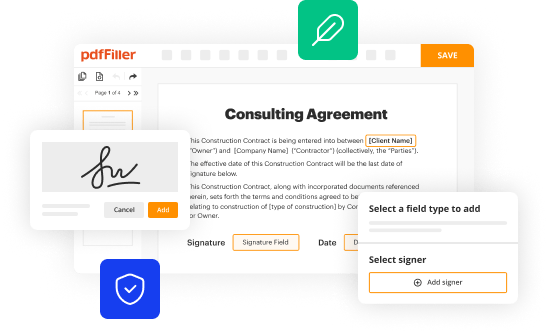

How to edit 2011 morehouse 1098 t online

How to fill out 2011 morehouse 1098t edit form

How to fill out Morehouse College Student Request for 1098-T Form

Who needs Morehouse College Student Request for 1098-T Form?

Video instructions and help with filling out and completing 2011 morehouse college form

Instructions and Help about 2011 morehouse 1098t create

So I have some bad news for you guys. If you have been taking advantage of education tax credits such as the American Opportunity Tax Credit or the Lifetime Learning credit, chances are you (or your tax preparer) have been calculating it all wrong. A few weeks ago, we posted a video on tax deductions for college students and in the comments we got a lot of questions about the 1098-T and how you use the 1098-T to calculate your tax credit. So this video is a follow-up to that video. So, if you haven’t seen that video, go watch that one first and come back to this one. It’s time to clear the air and learn how this is supposed to go. So here’s how a lot of people think the credit works. You put in the information from your 1098-T, subtracting your reported scholarships and grants in box 5 from the amount listed in either box 1 or box 2. That should give you the net amount of qualified expenses for which you can claim either the American Opportunity Tax Credit and/or Lifetime Learning Credit, right? WRONG. However, this is what a lot of tax preparers do and...

People Also Ask about 2011 morehouse 1098t fillable

How do I download my 1098-T?

Can I access my 1098-T form online?

Why can't I see my 1098-T form?

Can I file my taxes without my 1098-T form?

Can I fill out 1098-T online?

How do I get my last year's 1098-T?

What happens if I don't report my 1098-T?

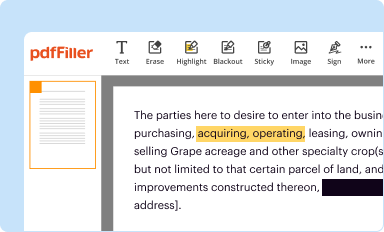

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

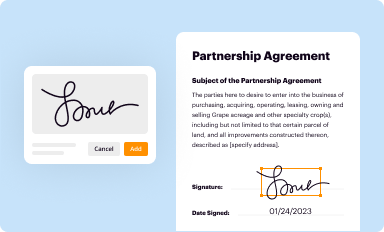

Can I sign the morehouse 1098 t electronically in Chrome?

Can I create an electronic signature for signing my morehouse 1098 t get in Gmail?

How do I complete morehouse 1098 form printable on an Android device?

What is Morehouse College Student Request for 1098-T Form?

Who is required to file Morehouse College Student Request for 1098-T Form?

How to fill out Morehouse College Student Request for 1098-T Form?

What is the purpose of Morehouse College Student Request for 1098-T Form?

What information must be reported on Morehouse College Student Request for 1098-T Form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.